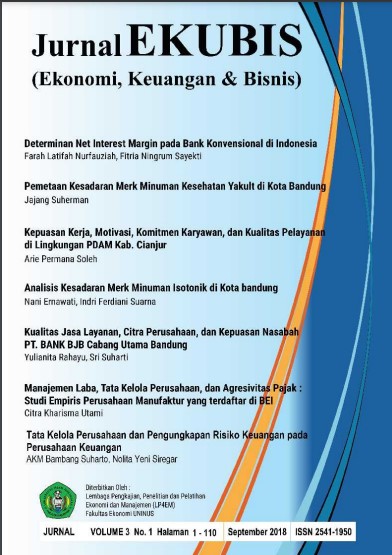

TATA KELOLA PERUSAHAAN DAN PENGUNGKAPAN RISIKO KEUANGAN PADA PERUSAHAAN KEUANGAN

Abstract

The purpose of this study is to empirically examine the effect of Good Corporate Governance on disclosure of financial risk in financial companies. Good corporate governant variables used in this study are the size of the board of commissioners, the number of board meetings, the composition of independent commissioners, the number of audit committee meetings, and the composition of the independent audit committee. The sample in this study used 66 of financial companies listed at Indonesia Stock Exchange (BEI) for 2015-2017, with 198 obervation. The sampling technique using purposive sampling method. The result of this study are size of the board of commissioners and the composition of independent commissioners have a positive significant effect on risk disclosure.References

Abeysekera, I. (2008). The influence of board size

on intellectual capital disclosure by Kenyan

listed firms. Journal of Intellectual capital,

(4), 504-518.

Aditya, H., & Meiranto, W. (2015). Analisis

Pengaruh Good Corporate Governance

Terhadap Risk Disclosure (Studi Empiris

pada Perusahaan Perbankan yang Terdaftar

di Bursa Efek Indonesia 2012-2014).

Diponegoro Journal of Accounting, 4(4),

-186.

Agustina, C. H., & Ratmono, D. (2014). Pengaruh

Kompetensi , Corporate Governance,

Struktur Kepemilikan Terhadap

Pengungkapan Risiko . Dipenogoro

Journal of Accounting , 3(4), 1-13.

Al-Akra, M., Eddie, I., & Ali, M. J. (2010). The

influence of the introduction of accounting

disclosure regulation on mandatory

disclosure compliance: evidence from

Jordan. The British Accounting Review,

(3), 170-186.

Andrés, P. d., Azofra-Palenzuela, V., & LópezIturriaga, F. J. (2005, March). Corporate

boards in OECD countries: Size,

composition, functioning and effectiveness.

Corporate Governance: An International

Review, 13(2), 197-210.

Arcaya, R. B., & Vázquez, M. F. (2005). Corporate

Characteristics, Governance Rules and the

Extent of Voluntary Disclosure in Spain.

Advances in Accounting, 21, 299-331.

Baidok, W., & Septiarini, D. F. (2016, Desember).

Pengaruh Dewan Komisaris, Komposisi

Dewan Komisaris Independen, Dewan

Pengawas Syariah, Frekuensi Rapat Dewan

Pengawas Syariah, dan Frekuensi Rapat

Komite Audit Terhadap Pengungkapan

Indek Islamic Social Reporting Bank

Umum Syariah Periode 2010-14. Jurnal

Ekonomi Syariah Teori & Terapan, 3(2),

-1034.

Brick, I. E., & Chidambaran, N. (2008, September).

Board Meetings, Committee Structure, and

Firm Performance. 16(4), 533-553.

Cresswell, J. W. (2014). Research Design:

Qualitative, Quantitative and Mixed

Methods Approaches. Sage Publication.

Creswell, J. W. (2012). Educational research:

Planning, conducting and evaluating

quantitative and qualititative research (4th

ed.). Boston: Pearson.

Effendi, M. A. (2016). The Power of Good

Corporate Governance (2 ed.). Jakarta:

Salemba Empat.

Ettredge, M. L., Johnstone, K., Stone, M., & Wang,

Q. (2010). The Effects of Firm Size,

Corporate Governance Quality, and Bad

News on Disclosure Compliance. Review of

Accounting Studies, 16(4), 866-889.

Fathimiyah, V., Zulfikar, R., & Fitriyani, F. (2012).

Pengaruh Struktur Kepemilikan Terhadap

Risk Management Disclosure (Studi Survei

Industri Perbankan yang Listing di Bursa

Efek Indonesia Tahun 2008-2010).

Simposium Nasional Akuntansi XV.

Banjarmasin.

FCGI. (2018). Peranan Dewan Komisaris dan

Komite Audit dalam Pelaksanaan

Corporate Governance (Tata Kelola

Perusahaan): Seri Tata Kelola Perusahaan.

Jilid 2, Edisi 2. Forum for Corporate

Governance in Indonesia.

Fortunella, A. P., & Hadiprajitno, P. B. (2015,

October). The Effect of Corporate

Governance Structure and Firm

Characteristic Towards Environtment

Disclosure. Diponegoro Journal of

Accounting, 4(2), 717-727.

Ghozali, I. (2011). Aplikasi Analisis Multivariat

dengan Program SPSS 19. Semarang:

Universitas Diponegoro.

Hapsari, A. A. (2017). Pengaruh Tata kelola

Perusahaan Terhadap Manajemen Resiko

pada Perusahaan Perbankan Indonesia.

Jurnal Muara Ilmu Ekonomi dan Bisnis,

(2), 1-10.

Herwidayatmo. (2000, Oktober). Implementasi

Good Corporate Governance untuk

Perusahaan Publik di Indonesia.

Usahawan, 10(XXIX), 25-32.

Ho, S. S., & Wong, K. S. (2001, Summer). A study

of the relationship between corporate

governance structures and the extent of

voluntary disclosure. Journal of

International Accounting, Auditing and

Taxation, 10(2), 139-156.

Jeppsson, H. (2013, December 13). Essays on

information asymmetry, disclosures and the

financing of R&D: The case of the

biotechnology industry. Doctoral

dissertation. Gothenburg: University of

Gothenburg, School of Business,

Economics and Law.

Khomsiyah. (2003). Hubungan Corporate

Governance dan Pengungkapan Informasi:

Pengujian Secara Simultan. Simposium

Nasional Akuntansi VI. Surabaya: IAI.

Komite Nasional Kebijakan Governance. (2008).

Pedoman Umum Good Corporate .

Pedoman. Komite Nasional Kebijakan

Governance.

Luayyi, S. (2010, Juli). Teori Keagenan Dan

Manajemen Laba Dari Sudut Pandang

Etika Manajer. Jurnal Akuntansi ElMuhasaba, 1(2).

Meilani dan Wiyadi. (2017). Determinan Finansial

Risk Disclosure: Studi pada Perusahaan

yang terdaftar pada Morgan Stanley Capital

International (MSCI) Indonesia Index

Jurnal Ekonomi Manajemen Sumber Daya,

-134.

Meilani, S. E., & Wiyadi. (2017, Desember).

Determinan financial risk disclosure: studi

pada perusahaan yang terdaftar pada

Morgan Stanley Capital Internasional

(MSCI) Indonesia Index. Daya Saing

Jurnal Ekonomi Manajemen Sumber Daya,

(2), 119-134.

Meizaroh, & Lucyanda, J. (2011). Pengaruh

Corporate Governance dan Konsentrasi

Kepemilikan pada Pengungkapan

Enterprise Risk Management. Simposium

Nasional Akuntansi, 14. Banda Aceh: IAI.

Nasution, M., & Setiawan, D. (2007). Pengaruh

Corporate Governance Terhadap

manajemen laba di Industri Perbankan.

Simposium Nasional Akuantansi X (pp. 1-

. Makasar : IAI.

Oorschot, L. v. (2010). Risk reporting: An analysis

of the German banking industry. Erasmus

MC: University Medical Center Rotterdam,

-165.

Pamungkas, I., & Muid, D. (2013, Juli). Analisis

Faktor-Faktor Yang Mempengaruhi Good

Corporate Governance Rating ( Studi

Kasus pada Perusahaan yang Terdaftar

Dalam Laporan Indeks CGPI Tahun 2009-

. Diponegoro Journal of Accounting.,

(3), 376-386.

Rifani, D. R., & Astuti, C. D. (2019, Januari).

Mekanisme Tata Kelola Perusahaan dan

Pengungkapan Risiko . Jurnal Informasi

Perpajakan, Akuntansi & Keuangan

Publik, 14(1), 1-18.

Siagian, F., Siregar, S. V., & Rahadian, Y. (2013).

Corporate governance, reporting quality,

and firm value: evidence from Indonesia.

Journal of Accounting in Emerging

Economies, 3(1), 4-20.

Siebens, H. (2002). Concepts and Working

Instruments for Corporate Governance.

Journal of Business Ethic, 39, 119-116.

Suhardjanto, D., & Anggitarani, A. (2010).

Karakteristik dewan komisaris dan komite

audit serta pengaruhnya terhadap kinerja

keuangan perusahaan. Jurnal Akuntansi,

(2), 125-139.

Suhardjanto, D., & Dewi, A. (2011, Januari).

Pengungkapan Risiko Finansial dan Tata

Kelola Perusahaan: Studi Empiris

Perbankan Indonesia. Jurnal Keuangan

dan Perbankan, 15(1), 105-118.

Suhardjanto, D., Dewi, A., Rahmawati, E., & M, F.

(2012, November). Peran Corporate

Governance dalam Praktik Risk Disclosure

pada Perbankan Indonesia. Jurnal

Akuntansi & Auditing, 9(1), 16-30.

Vafeas, N. (1999, July). Board meeting frequency

and firm performance. Journal of Financial

Economics, 55(1), 113-142.

Walker, G. (2003). Modern Competitive Strategy.

New York: McGraw-Hill.

Wibowo, A. E., & Probohudono, A. N. (2017).

Board of Commisisioners , Organizational

Culture , dan Financial Risk Disclosure di

Indonesia (Studi pada Perusahaan yang

Tercatat di Bursa Efek Indonesia Tahun

-2015). Simposium Nasional

Akuntansi XX, (pp. 1-24).